Forex Elliott Wave Indicator

This article will give you everything you need to know about the Elliott Wave Indicator. We will look at what it is, how to use the Elliot Wave indicator in trading, what you need to know about the Elliott Wave principle, what the Elliott Wave Oscillator is, and more!

What is the Elliott Wave?

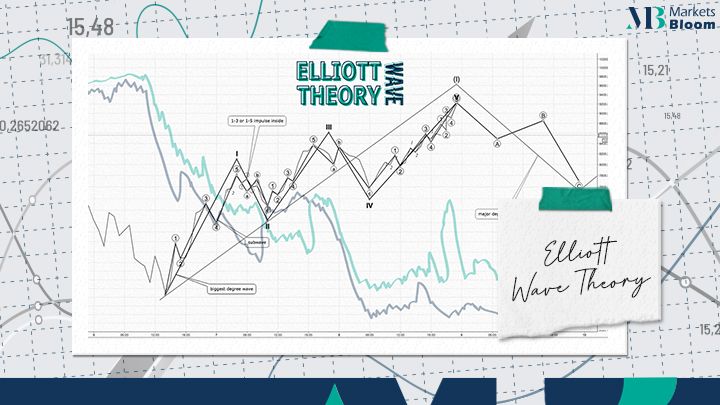

Ralph Nelson Elliott created the Elliott Wave Theory in the 1920s. Elliott discovered that market movements consisted of investors’ reactions to various macro-stimulus. Moves to the upside or downside can be seen frequently in the same patterns, regardless of the outside stimulus.

Also, it can be divided and analyzed into smaller moves called “WAVES”. Traders were then able to foretell the repetitive cycles of the market for the first time.

Elliott’s wave theory is partly based on the older theory of Dow. The contrast between the 2 theories is that Elliot discovered the more fractal nature of the Forex markets. The Elliott Wave states that prices move in wave formations that can be seen as directing price movement. This makes you categorize any given price movement into impulsive moves or retracements before the price changes its overall structure.

This complex form of market analysis has become widespread among pro traders. More detailed studies have been conducted by A.H. Bolton, Charles Collins. Later the theory was completely covered in Robert Prechter’s book ‘Elliott Wave Theorist’. In simple terms, Elliott wave analysis displays traders’ behavioral patterns on a chart. Elliott never wanted to use his results to individual stocks, because the low-activity environment of the time caused inconsistent mass behavior patterns.

Introducing the Elliott Wave Oscillator

The Elliott Wave Oscillator (EWO) allows the traders to notice when one wave ends, and a new one starts.

This Forex Wave Indicator is called the 5/34 oscillator because it has a 34-time simple moving average subtracted from a five-time simple moving average. The EWO’s reading is a clear signal of the placement of the 3rd wave. It’s a great Forex wave indicator because it has a strong association with Elliott wave patterns. This makes it perfect as a filter of fake ones.

How to Read the Elliott Wave Oscillator?

When rightly applied to a trading chart, the Elliott Wave Oscillator is shown with a histogram split of 2 areas ” one positive and one negative.” As a new wave starts to form, it will often begin by showing a divergence between the EWO and the price. The rule of thumb is that the first wave can always be found where a change of the latest trend has happened. After that wave, there will be a pullback to the already-changed direction of the price.

This retracement of the new move is usually the 2nd wave. It is important to know that during wave 2, the market will not reach a new extreme. In most cases, it will cover a Fibonacci percentage of wave 1. This event is identified with the Elliott Wave Indicator for trading. When a correction is spotted, and then confirmed by the EWO, you will find that waves 2 and 4 are always the corrective ones.

The second rule of thumb

is that good traders always merge the corrective waves with Fibonacci retracements. After the retracement of wave 1 has ended, you will see the strongest price move of the two before that. This move is wave number 3, and it can be spotted easily.

The market will reach a new HIGH or LOW depending on whether wave 1 was BULLISH or BEARISH. Represented with a Fibonacci Extension, this move has a profit target between ( 100% to 173.6% ) of the size of the move of wave 1. Note that the Forex Elliott Wave Indicator does not give exit points. In wave 5, the price will make a new high, but the Forex Wave Indicator will not show a higher reading than it did on wave 3. This will make a divergence between the indicator and the price.

About Marketsbloom:

Markets Bloom is a trading academy consisting of former trading industry professionals. Our aim is to help all types of traders looking to trade in the financial markets.

By registering with us, you will gain amazing insights into common issues traders face as well as how to instantly improve your trading approach. Our team of experts will be with you every step of the way on your journey to becoming a better trader.

For more information on our services contact us or you can visit our facebook page for the latest news by clicking here .