How to trade the Fed funds rate decision

Did you know that the announcement of the fed funds rate is possibly the most watched and traded event for traders and investors all over the world? The Fed’s rate decision affects not only the US economy but also the world economy. However, it also has a big impact on financial markets including currencies, stocks, bonds, and even commodities.

How to trade Fed rates? What is the Fed funds rate?

The fed funds rate is the profit rate banks charge each other to lend federal reserve funds overnight. Banks take these funds from one another to meet and maintain strict reserve requirements.

It is also used as an instrument by the federal reserve to manage the country’s money supply to achieve a healthy economy, while also serving as a standard for-profit rate on savings, loans, credit cards, and more. Any changes in the profit rate cause significant movement in the financial markets, especially the US dollar.

How to trade fed rates? How is the rate determined? When will it be released

The Fed has a mandate to conduct monetary policy to reach its macroeconomic objective of “maximum employment and stable prices.” To do this, the Fed built its own policy-making body called the Federal Open Market Committee “FOMC” which is composed of 12 members; 7 members of the Board of Governors and 5 of the 12 Federal Reserve Bank presidents.

The FOMC schedules 8 meetings per year but also holds unscheduled meetings to review economic and financial developments. It is in these meetings where the FOMC decides where to put the fed funds rate, also called the Fed interest rate or just the fed rate.

How to trade Fed rates? What causes changes in the rate?

One of the most important goals for the Federal Reserve is to keep inflation firm at a rate of 2 percent. Inflation refers to the rate at which the price of goods and services rises. While there are several factors the FOMC takes into consideration when setting interest rates, inflation is one of the largest influencers.

If inflation gets too high, the Fed may look to raise the Fed funds rate. This lowers the number of money banks has to lend which slows consumer taking and demand. It can make consumer debt more expensive, forcing people to spend less thereby reducing demand and bringing prices of goods and services lower.

If inflation decreases, it is an indicator that consumers are not spending, among other things. This is a problem for the large bank as it could lead to an economic downturn. In this case, the Fed is more likely to cut benefit rates to stimulate economic activity. A lower benefit rate means low-cost borrowing for consumers and businesses which in turn could lead to economic growth.

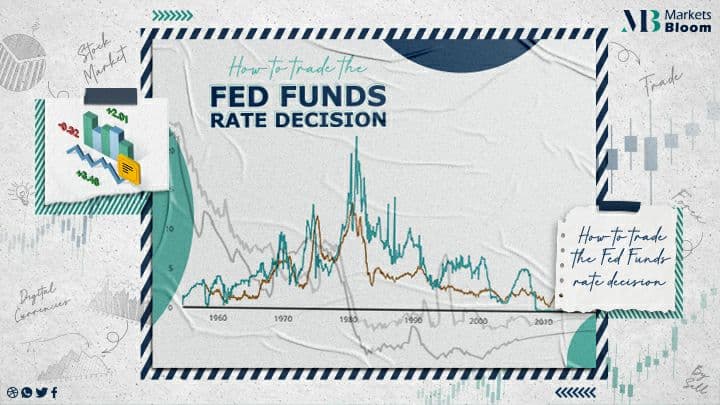

We can see this association when showing Fed interest rate history.

How to trade Fed rates? What can we get from Fed’s interest rate history?

There is a clear association between the Fed’s interest rate history and inflation.

From 2016, there has been much more movement in inflation and interest rates, making the next decade be involved in the financial markets. In fact, from 2016 to 2019 there were many Fed rate hikes, before a few Fed rate cuts in 2019.

Fed interest rate decision

You may be wondering how traders practically use this to trade from?

It includes showing how the market’s price action responds to the Fed’s decision.

What effect does the rate decision have on markets?

Interest rates have the ability to command the flow of capital into and out of a country.

When it comes to the Fed rate decision and its effect on the US dollar, it can be tricky as the US economy is the world’s largest. If the US economic extension is poor, then it’s likely the world economy is doing poorly. Therefore, if the Fed cuts rates to stimulate the economy, investors may keep their capital in US dollars as it’s the world’s reserve currency and is considered as one of the safest and most stable of world currencies to hold.

How to trade Fed rate decisions?

For traders, one of the methods to trade a possible Fed rate hike, or Fed rate cut, is to try and capitalize on the potential volatility of the news declaration. Markets tend to trade slow in the run-up to high-impact news declarations before increasing in volatility once the result is declared.

How to trade Fed rate decisions via the US dollar index?

The US dollar index gauges the performance of the US dollar against a basket of foreign currencies

In the days before the FOMC Fed rate cut, the ATR stayed relatively flat. This is evident in analyzing the price action before the declaration which also stayed relatively flat. How can traders try to capitalize on this? Here are a few options:

Identify the pre-FOMC trading range & trade a breakout of the range.

Identify the pre-FOMC trading range & trade a false breakout of the range.

Wait for a price action trading signal & then trade the signal accordingly.

About Marketsbloom:

Markets Bloom is a trading academy consisting of former trading industry professionals. We aim to help all types of traders looking to trade in the financial markets.

By registering with us, you will gain amazing insights into common issues traders face as well as how to instantly improve your trading approach. Our team of experts will be with you every step of the way on your journey to becoming a better trader.

For more information on our services contact us

or visit our Facebook page Markets Bloom for the latest news