Investing in Istanbul Stock

This article from MarketsBloom Academy will help you start Investing in the Istanbul Stock Exchange, how to buy shares from the minimum amount required to open an account to some ideas to consider in your portfolio.

How to invest in Istanbul Stock Exchange in 6 steps

1. Select a broker: Brokers are certified brokers for trading financial assets on the Istanbul Stock Exchange.

2. Open a trading account with a local broker: the only condition is to be of legal age and have a residence in Turkey. The broker will provide. you access to its investment platforms, allowing you to send purchase and sale orders to the central system of the Istanbul Stock Exchange.

3. Choose a financial asset to invest in: An investor must decide whether to invest in stocks, sovereign bonds, or corporate bonds.

4. After making the decision, send a purchase order. through the broker: this means you have to submit a purchase order for a financial asset. It is possible to determine a specific price or market price for a specific asset.

5. The financial transaction becomes effective when the .sale and purchase price correspond: when the offer price (buyer) of a financial asset matches the asking price (seller), the transaction is executed. Brokers pay on the stock exchange in your name and hand over the transaction amount to the buyer/seller. Become the legal owner of the asset.

6. The broker issues a transaction notice and fee: There are no fixed fees, which means that when choosing a broker to invest on the Istanbul .Stock Exchange, you will have to choose a broker who can better adapt to your investment strategy.

How Istanbul Stock Exchange Works

The Borsa İstanbul A.Ş, abbreviated as BIST in 2012, serves as a stock exchange for Turkish financial assets. It brings all exchanges operating in Turkish capital markets under one roof. The basic purpose of the Turkish stock exchange is described as follows:

By the relevant provisions of the law and legislation, to ensure. that the instruments of capital markets, foreign currencies, precious metals, precious stones, and other contracts and documents and assets approved by the Capital Markets Council of Turkey. are subject to free trading trade conditions simply and securely, in a transparent, effective, competitive, fair and stable environment;

To establish and develop markets, sub-markets, platforms, regulations, and other regulated market premises to conform or facilitate. conformity with the purchase and sale orders of the above-mentioned assets and to identify and advertise the prices discovered; to manage and/or operate the above-mentioned exchanges or markets or other exchanges or markets and to implement other activities included in their statutes “.

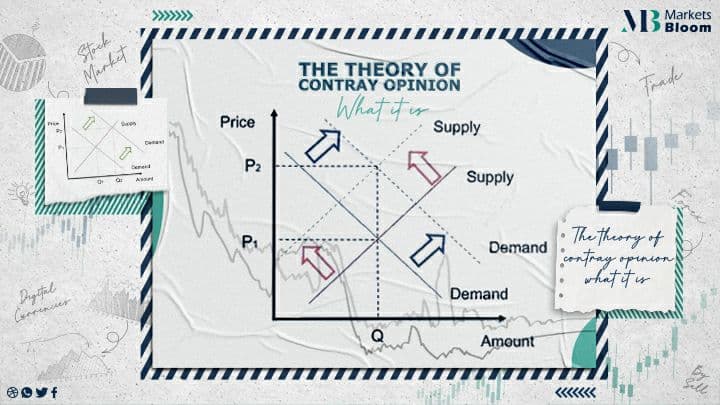

The Istanbul Stock Exchange is a self-regulated entity (meaning that it is not overseen by a government agency). In short, the stock exchange is the institution that facilitates the negotiation of financial instruments in Turkey. Supply and demand for financial instruments such as stocks, bonds, and currencies and demand for these instruments (i.e. investors) interact.

The exchange holds daily “trading sessions” that provide it with physical, technological, human, and operational means that allow effective communication between brokers, exporters, and investors.

How to trade on the stock exchange

The investment flow of any financial instrument can be summarized as follows:

• Sellers (supply) offer to sell a financial instrument at, for example, a company’s bond. Sellers aim to make this price as high as possible (price 1).

• Investors (application) wishing to obtain the bond offering at a specific price level. They want this price to be as low as possible (price 2). After that, price 1 is higher than price 2.

• Buyers interact with sellers until they reach the point where price 1 is equal to price 2. When this happens, trade occurs, and bonds are exchanged between the seller and the buyer. The broker is required to complete this transaction: the broker is a company that mediates between sellers and buyers, and requests prices and quantities .of financial instruments. Below are the services offered by these companies.

Once you sign up with us, you will deal. with a support employee from the company. in addition to a wide range of tips and instructions that will guarantee you a large profit.

Do not hesitate!

Now if you do not have enough time to analyze the market, Investing in Istanbul Stock.., you can talk with the experts or you can contact the company via WhatsApp and enjoy the best services in the field of trading.

You can also visit our website: Markets Bloom .. and our Facebook page: MarketsBloom