Knowing market movers to improve your trading

Whether you are a beginner trader, investor, or you are a pro trader, this article will help you define your analysis priorities before entering or exiting a market.

What are market movers? meaning & definition:

When we say “market mover” we mean any event or factor capable of affecting the market and generating a move. Also influencing the performance of a specific financial tool. Each market mover has a different impact and scope, and can be expected or unexpected events.

Predictable Market Movers include Macroeconomic data, expected inaccurate days and periods, and easily available on an Economic Calendar. Macro data, large bank meetings and statements, quarterly corporate data, political events, and elections are all considered traceable and predictable market movers. Every trader must be prepared for these events.

Sudden market movers are unique events. A striking example is the spread of the COVID19 in Europe and the USA in March 2020.

What are the trading market movers in this type of analysis “fundamental analysis”?

Firstly, we can divide the market movers into 2 categories:

-Positive or negative events: data with these features relating to a specific market can affect both upside and downside.

-Events over or under expectations: it’s news that deviates from a definite forecast, increasingly affecting the upward and downward trends of a given asset.

There are three major market movers:

1-Economic Indicators :

Involve all those data and statistical indicators concerning the performance of a specific economy or economic sector.

-Gross Domestic Product (GDP): is a measure that aims to provide a monetary value to the overall size of an economy over a given period “a year”. By comparing the size of Gross Domestic Product, or its rate of change, over several months, quarters, or years, one can understand a lot about the health

of a given economy.

-Employment: it shows us the percentage of citizens with work or employment. This is strongly related to GDP as it participates in economic growth. The employment of citizens agrees with production, consumption, and income from taxes. The indicators used to gauge employment are unemployment rates.

-Debt / Gross Domestic Product Ratio: the ratio of a country’s debt to its productive value over a year.

-Public deficit: it is of the state that happens when the expenses exceed the income or the state budget is negative.

-Inflation: indicates the extended increase in the general average level of prices of goods and services over a given period, which produces a decrease in the purchasing power of money.

-Consumption: is the increase in demand for goods and services. As consumption increases, demand, production and so GDP increase.

European Economic Indicators :

-Eurozone CPI or Consumer Price Index of the Eurozone (EU inflation), monthly & quarterly.

-German Zew PMI or German Economic Sentiment Index, monthly

-German manufacturing index – monthly

-GDP of member countries

-Unemployment of member countries

US Economic Indicators :

-GDP or “Gross Domestic Product” compared with annual or quarterly data and issued quarterly by the Department of Commerce.

-Unemployment or “Unemployment Rate” published monthly by Labor’s Department.

-NFP or Non-Farm Payroll, published monthly, is one of the most predicted indicators of economic

growth.

-Industrial Production regarding the manufacturing production of companies, published monthly by the FED.

-Consumption data or “Consumer Spending” about the trend in consumption data depicting two-thirds of economic activity, published monthly by the Department of Commerce.

-Home Sales or “Home Sales” released by the Department of Commerce monthly to gauge consumer sentiment and new home purchases.

-Sales or “Retail Sales” published by the Department of Commerce monthly to gauge the health of consumers. It represents growth in retail sales.

2-Financial Indicators :

The ECB Rate Decision or decision of the European Central Bank on interest rates,quarterly

US inflation or CPI, monthly.

All press releases and events related to large banks

Financial Indicators are the indices that in the financial statements give a detailed analysis of a company’s performance, communicating the company’s ability to reach and keep a financial balance.

The indices that give information on financial performance:

-Leverage.

-The degree of financial independence.

-Liquidity.

-ROI, return on invested capital.

-ROE, return on equity.

3-Political Factors :

Political factors are easy to understand and interpret. It’s obvious that a country facing a political election will experience exceptional market movements.

Among the political factors we can include:

Tax policies

Labour law

Environmental law

Trade restrictions

Political stability

Pre Market Movers:

All those events or factors that affect fluctuations in the financial markets happen before the daily opening on the markets in question.

A pre-market mover refers to a market mover event that happens after the close of quotes on the trading day and before the opening of the next day.

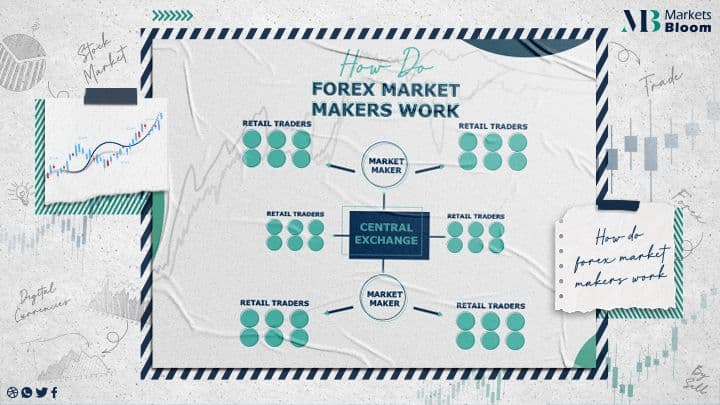

Trading market movers and Forex market movers :

The Forex market is no exception as far as today’s market movers are concerned: the events and indicators that move the market are the same and also apply to currencies.

It’s important to know that all the above events will affect the respective currency:

-All publications related to the US economy will have an effect on the US dollar and then on related pairs (EURUSD, etc…..)

-All publications relating to the European Union will influence the Euro and related pairs.

-The different national announcements will influence the country’s currency and related pairs.

Market movers and fundamental analysis- Seasonality

What is seasonality?

Is an anticipated change that happens every year in the same period. There is no guarantee that historical patterns will repeat themselves, but whenever a pattern has been repeated 80% to 90% of the time, it becomes statistically important.

The best seasonal market movers :

SP500:

Statistical data came from a 50-year study period, identified seasonal patterns in the SP500 index:

The last quarter of the year is commonly BULLISH.

Sep is historically the worst month of the year BEARISH.

The best time to invest upwards on the index is from Nov to Apr

Other market indices:

The seasonality in the stock market indices is uniform: the statistical data focus on the weakness of the markets during the summer months.

About Marketsbloom:

Markets Bloom is a trading academy consisting of former trading industry professionals. Our aim is to help all types of traders looking to trade in the financial markets.

By registering with us..you will gain amazing insights into common issues traders face as well as how to instantly improve your trading approach. Our team of experts will be with you every step of the way on your journey to becoming a better trader.

For more information on our services contact us , follow our facebook page Markets Bloom for more information.