Understanding the meaning of forex spread

The Forex spread is a basic concept when it comes to trading. It is something that you must understand to become a successful trader. In this article..we will explain what a spread is, why it is important, how to measure it, and much more !

The forex spread meaning:

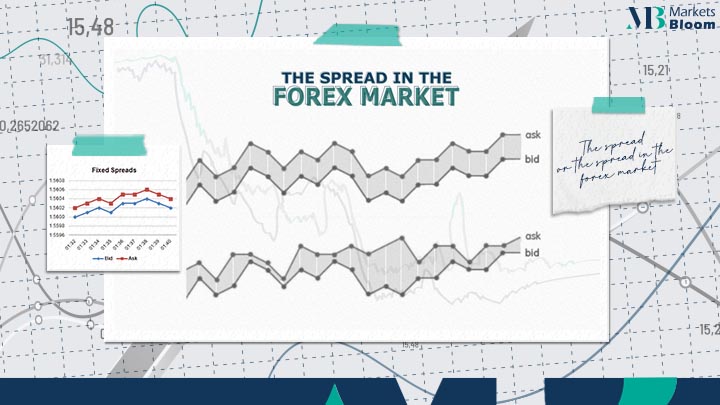

In the fx and other financial markets.. the spread is the difference between the purchase price and the sale price of an asset.

With online brokers, the purchase price is higher than the sale price of an asset ” if you opened a position and closed it straight away, you would make a loss exactly equal to the spread”.

Hence, when you open a trade..you need the market to move in your favor in an amount equivalent to the spread before you can start to potentially make a profit.

How is the spread measured?

In the fx market.. a pip is the fourth digit after the decimal point in an exchange rate, and it is in pips that the fx spread is measured.

The spread differs for each broker and also depends on volatility and volumes traded on a tool. The EUR/USD is the most traded currency pair and enjoys the lowest spreads.

How to calculate the value of the spread in forex

The cash value of the spread depends on the size of the contract you are trading.. as this determines the size of each pip.

In Forex, to calculate the pip value in the quote currency you multiply 0.0001 by the size of the contract.

Factors that influence the spread in trading :

The liquidity of the asset being traded

Market conditions

The volume traded of a financial tool

Spreads depend on the basic asset which is being traded. The more an asset is traded, the more liquid the market. The more liquid the market, the smaller the spreads. In markets with low liquidity, such as the natural gas market, the spreads tend to be larger.

also:

Spreads differ according to market conditions. There are larger spreads during macroeconomic announcements and times of high volatility.

Volume could have an impact on the spread. If your trade is large and it moves the market against you, then the market maker is likely to adjust their spread to compensate for the additional risk they are taking. In practice, the fx markets are so liquid that retail trades are very unlikely to make an impact on the market price.

About Marketsbloom:

Markets Bloom is a trading academy consisting of former trading industry professionals. We aim to help all types of traders looking to trade in the financial markets.

By registering with us, you will gain amazing insights into common issues traders face as well as how to instantly improve your trading approach. Our team of experts will be with you every step of the way on your journey to becoming a better trader.

For more information on our services contact us and you can visit our facebook page .