What is short selling?

In this article, we will explain everything you need to know about short selling. What do we mean by “to short a stock”, how short selling works, why you should consider short selling via CFDs, how to short a stock CFDs, the finest stocks to short, and what markets you can trade short positions on!

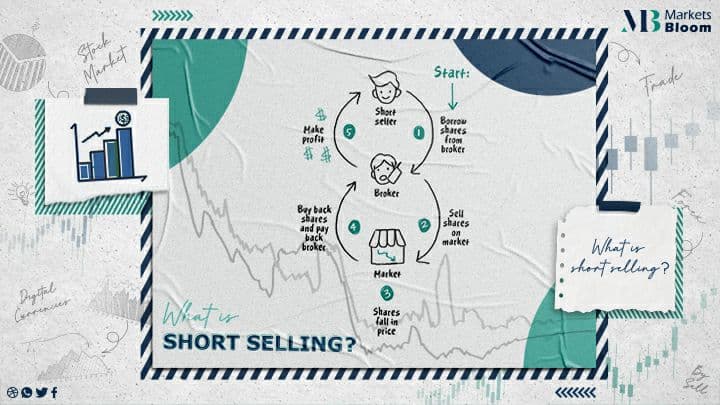

What is short selling?

Short selling is taking a BEARISH trade on an asset. You sell high and purchase low, and make a profit on the change in the asset’s price.

How does short-selling work?

For a traditional short sale, a trader starts by taking the shares of a stock that they do not own. Then they sell these shares on the open market at the lower-level market price.

The aim of the short seller is to later re-buy those shares at a lower-level price, and return taken shares.

Mathematical formula of a short-selling

This formula is simple. Online brokers display net profits and losses on trading platforms. The lower the repurchase price of your shares relative to your selling price, the more money is earned. And the lower-level the price of the stock sold short, the more to make important gains.

The formula is:

( sell price- buy price ) x number of assets – transaction cost = profit

The breakdown of each part of this formula:

Sell price : price at when the trader sells the financial securities

Buy price : price at when the trader redeems the sold securities

Number of assets : the assets that sold by the trader

Transaction cost = Broker’s commission

If the outcome of this formula is:

Positive: the trader realised a net gain

Negative: the trader realised a net loss.

What markets can you trade a short position on?

What other assets can you take a short position on? Here are some examples:

Forex

Commodity CFDs

Index CFDs

Bond CFDs

Share CFDs

The most common US stocks for short selling:

Disney

Apple

Netflix

Tesla

Alibaba

Microsoft

Amazon

Deutsche Bank

Short selling with technical analysis

One of the most common short-selling strategies used in technical analysis is to open a trade after the affirmation of a BEARISH breakout on an uptrend line.

The 2nd one is to identify a downward flip figure such as a shoulder-head shoulder, an ascending level, or a double-top. To increase your chances of winning, you can combine BEARISH breakout on the bullish line with the flipping figure.

The 3rd strategy is to play price differentials with moving averages.

Short selling protection rules for financial authorities:

The basic protection against short-selling speculators is the brokers and financial intermediaries who perform the transaction between the trader, who take the securities, and the lender, who lends his securities to the trader. Regulators will demand brokers to own a percentage of the loaned securities.

The 2nd rule of protection used by regulators is the obligation to publish short-selling positions held in the portfolio.

How short selling can bring balance to stock markets?

It naturally regulates stock markets and brings liquidity to financial markets. Starters launching alerts to detect fraud.

About Marketsbloom:

Markets Bloom is a trading academy consisting of former trading industry professionals. We aim to help all types of traders looking to trade in the financial markets.

By registering with us, you will gain amazing insights into common issues traders face as well as how to instantly improve your trading approach. Our team of experts will be with you every step of the way on your journey to becoming a better trader.

For more information on our services contact us , follow our Facebook page Markets Bloom for the latst news.