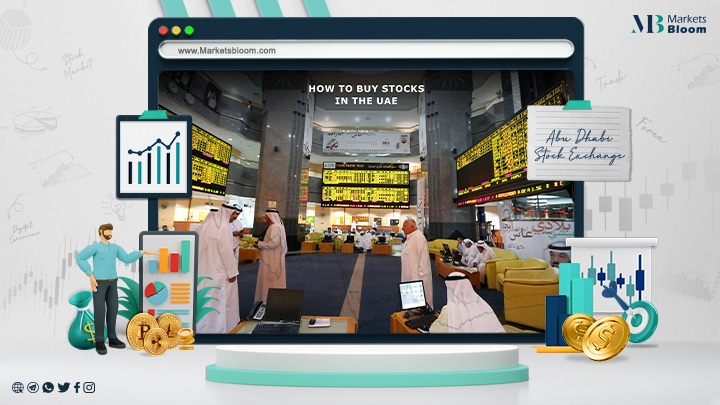

Abu Dhabi Stock Exchange

Abu Dhabi Stock Exchange Market is the second largest market in the Arab world. Its strategy to secure stable financial performance with diverse sources of income is in line with the fundamentals and guidelines of the UAE’s “Prepare for 50” agenda.

In this article, we will learn the most important information about the Abu Dhabi Financial Market, its objectives, and how to invest in it.

About Abu Dhabi Stock Exchange

The Abu Dhabi Financial Market was established in 2000 under Local Law No. 3 of 2000. Under that law, the market is characterized by legal personality and financial and administrative independence. It also has the necessary supervisory and executive powers to exercise its functions.

Also in 2020, the Abu Dhabi Financial Market was converted from a public enterprise to a public joint stock company based on Law (8) of 2020. The Abu Dhabi Financial Market is affiliated with ADQ, which is one of the largest holding companies in the region and has a wide portfolio of major companies operating in key sectors of Abu Dhabi’s diversified economy.

The Abu Dhabi Financial Market is a market for trading securities, including shares issued by public shareholding companies, exchange-traded funds, and bonds issued by governments or companies. In addition to any other financial instruments approved by the UAE Securities and Commodities Authority.

Abu Dhabi Financial Market Objectives

Abu Dhabi Financial Market has a set of objectives:

Securing opportunities to invest savings and funds in securities to support the national economy.

Ensure the integrity and accuracy of transactions and ensure the interaction between supply and demand to determine prices.

Secure investor protection by establishing fair and appropriate dealing principles for different investors.

The Abu Dhabi Financial Market also imposes strict controls on securities transactions to ensure the proper functioning of the procedures.

Developing investment awareness by conducting studies to ensure that savings are invested in productive sectors.

In addition to supporting financial and economic stability and developing trading methods to enhance liquidity and stabilize the prices of all securities listed on the market.

How to Invest in Abu Dhabi Stock Exchange

To become an investor in the Abu Dhabi Financial Market, you need to issue the investor number. The investor number is an investor identification number issued through the Department of Clearing, Settlement, and Deposit, through which all transactions in the Abu Dhabi Financial Market are initiated from settlement, trading, and other transactions.

An investor can apply to issue an investor number in the Abu Dhabi Financial Market through one of the following service channels:

For UAE ID holders, Sahmi Digital Platform.

Customer service offices at all branches of the Abu Dhabi Financial Market.

Certified brokerage companies.

Documents required for issuance of investor number:

Individuals:

Original Emirates ID card for UAE nationals and residents holding UAE identity.

Foreigners who are not residents in the UAE have a passport and a personal card.

International Bank Account Letter (IBAN) provided that the bank account is single in the applicant’s name and not a joint bank account.

Companies:

Company’s founding contract.

The copy of the commercial license is valid.

A list of the company’s board members for the last certified period.

International Bank Account Letter (IBAN).

Letter to authorized signatories.

Investment portfolios:

Copy of the business license of the issuer of the wallet.

Letter of approval by the Central Bank for the beginning of the portfolio activity.

List of names and signatures authorized by the wallet with clarification of powers.

International Bank Account Letter (IBAN).

Portfolio Issuance Brochure (Prospectus).

Free zones:

Copy of Free Zone License.

List of members of the Board of Directors of the Company for the last certified period.

Letter to authorized signatories.

International Bank Account Letter (IBAN).

Trading in Abu Dhabi Financial Market

To start trading in Abu Dhabi Financial Market, you need to follow these steps:

1. Get an investor number.

2. Then choose a financial broker.

3. Then, start selling and buying shares by placing orders.

An investor should monitor the movement of stocks through in-market trading screens, through the market website, or through applications provided by brokerage companies, and then make a purchase or sale decision.

Once you sign up with us, you will deal with a support employee from the company. in addition to a wide range of tips and instructions that will guarantee you a large profit.

Do not hesitate!

Now if you do not have enough time to analyze the market.., you can talk with the experts or you can contact the company via WhatsApp and enjoy the best services in the field of trading.

You can also visit our website: Markets Bloom .. and our Facebook page: MarketsBloom