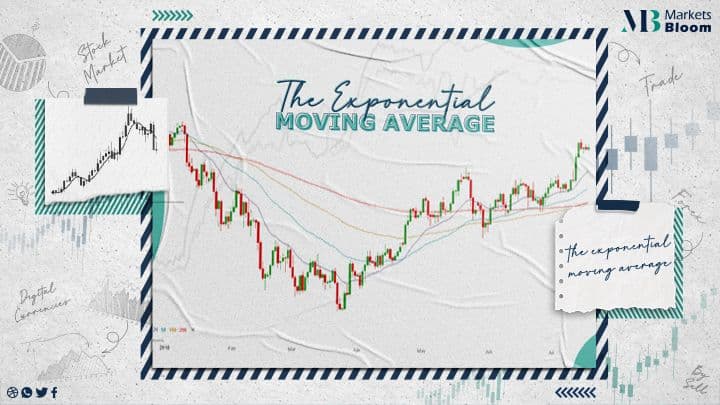

The Exponential Moving Average

This article will discuss a definite type of Moving Average known as the ‘Exponential Moving Average’ (EMA). We will also look at an easy-to-use trading tool called the ‘Exponential Moving Average Indicator’ that uses this method to evaluate trends within the FX market.

What is The Exponential Moving Average?

An important type of tool for evaluating trends is the Moving Average. We apply moving average to smooth out differences in data, to better note the basic trend. They do this by looking back at a new number of data points and then calculating some form of the average of the values. There is more than one method to calculate an average, and there are several types of MA.

The easiest method is the Simple Moving Average (SMA), which considers all price values equally.. and takes the mean as the average. Other popular types of Moving Average assign a weighting to various price values.. favoring new prices more heavily than older prices. This is the way in which the exponential moving average model acts, with the amount of weighting assigned to a price decreasing exponentially as we go backward in time.

What is the Exponential Moving Average?

It is difficult to give a sufficient Exponential Moving Average definition without getting into the specifics of the calculations involved. A broad EMA definition is: a smoothing technique arrived at by adding a portion of the latest price, to a portion of the value of the last moving average.

How to Calculate an Exponential Moving Average?

We calculate an Exponential Moving Average At the time – t – using the EMA formula as follows:

EMAt = α x latest price + (1- α) x EMAt-1

Where ‘α’ is a smoothing constant with a value between 0 and 1, at-1 is the EMA for the last period. You can see from this that calculating the Exponential Moving Average for a given point in time requires us to have performed prior calculations, to know the EMAs for past times. For a daily EMA, we derive the latest value from the prior day’s EMA.

EMA Indicator in MT4

The Exponential Moving Average Indicator comes with the MT4 download, It is listed as one of the Trend indicators within MT4.

Also The MA method field defines the kind of moving average that you’ll add to the chart. The two EMA settings are ‘Period’ and ‘Shift’. And The most important setting to choose is the exponential moving average period. The larger the time, the smoother the chart.

The smaller the time, the more receptive the EMA line will be in responding to the price. Some typical EMA settings are 10 & 25 times for faster, more responsive curves; 100 & 200 periods for very smooth, slow-moving curves; and 50 periods for an intermediate curve.

The shifting setting acts by offsetting the EMA curve along the x-axis by the number you choose. And The default value of zero for the shifting setting is a fine place to start.

The EMA chart indicator looks like a dotted green line with the settings we have chosen. And The EMA indicator line is much smoother than the movements of the basic price, It traces the general movement of the market, but it effectively filters out price noise, displaying a clearer indication of the overriding trend.

About Marketsbloom:

Markets Bloom is a trading academy consisting of former trading industry professionals. Our aim is to help all types of traders looking to trade in the financial markets.

By registering with us, you will gain amazing insights into common issues traders face as well as how to instantly improve your trading approach. Our team of experts will be with you every step of the way on your journey to becoming a better trader.

For more information on our services contact us

our facebook page: Markets Bloom