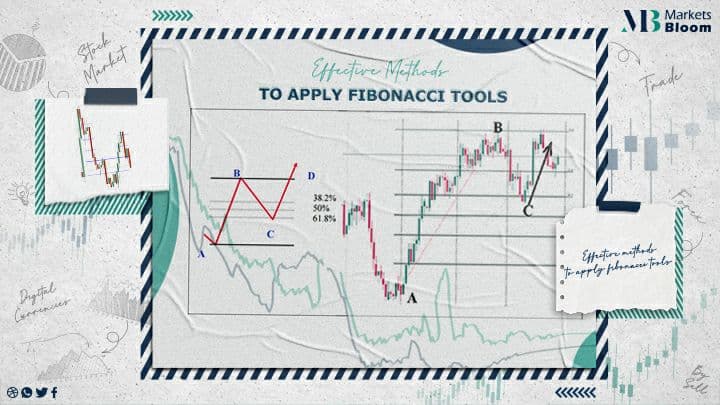

Effective Methods to Apply Fibonacci Tools

This article will discuss: what is Fibonacci? Fibonacci sequence levels, Fibonacci Fan strategy, and how to apply Fibonacci tools properly with three contrasting methods that will improve the effectiveness of your trading strategy, as well as some other main topics that are helpful in relation to Fibonacci tools.

Leonardo Bonacci aka Fibonacci:

Leonardo Bonacci aka Fibonacci an Italian mathematician was born in Pisa around 1170. He was considered to be the most talented western mathematician of the Middle Ages. His book ‘Liber Abaci’ presented the Hindu-Arabic numeral system.

What is Fibonacci?

The Fibonacci sequence refers to a set of numbers that starts with either the number one or the number zero, succeeded by another number one, and then the pattern continues based on this rule:” all subsequent numbers or Fibonacci numbers will be equal to the sum of the two previous numbers.”

Today, Fibonacci levels are used in all kinds of trading including “stocks, futures, commodities, cryptocurrencies, and also fx trading”. The Fibonacci levels, with their retracements and targets, are one of the finest tools in the whole field of technical analysis. Its powerful support & resistance levels are exact and explicit. Fibonacci offers a defined and precise entry and exit spots. The Fibonacci levels (Fibs) are derived from the Fibonacci sequence numbers.

Fibonacci Sequence Levels:

The Fibonacci sequence numbers are : 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, etc. This series of numbers is created by adding the last two numbers together:

0 + 1 = 1

1 + 1 = 2

1 + 2 = 3

2 + 3 = 5

3 + 5 = 8 etc.

89 + 144 = 233,

144 + 233 = 377, etc

That the Fibonacci sequence numbers are strongly respected on the charts, as a huge majority of traders use them.

That the Fibonacci sequence levels are used for calculating Fibonacci retracements and targets, which are levels regularly used in the market.

These numbers can be observed all around us: In crystal formations, or by being played out in musical progressions. The whole human body is full of Fibonacci relationships

The Fibonacci Fan Strategy:

~The Fibonacci Fan consists of 3 lines set at the basic Fibonacci retracement numbers. Those are:

38.2%

50.0%

61.8%.

The major supporting level on the Fibonacci Fan is (61.8%). By applying the following rule, we might have a good possibility for an entry purely based on Fibonacci Fan trading. Fibonacci Fan is the default indicator on MT4 & MT5, and you can assess it directly. Once the price breaks the 38.2% level, it will go to the 61.8% level. You can make an entry at 38.2, aiming for 61.8. This rule works best in a trending environment, it can be used in a countertrend.

Fibonacci Tools: Fibonacci Expansion Custom Levels:

Fibonacci Expansion is a default tool available in MT, which is also important for price action targets. In order to add custom levels to the Fibonacci Expansion tool, firstly you need to choose the tool from the drop-down menu in MT4.

Once you have chosen the tool in ‘Properties’, add the following levels:

1-FE 61.8

2-FE 100.0

3-FE 138.2

4-FE 150

5-FE 161.8

6-FE 200

Enter one of these levels manually within the indicator properties.

The features of these levels are important for the price analysis and will add up to 1-2-3 pattern trading.

Fibonacci Expansion 61.8

This is the first major level of the tool. It doesn’t act as strong support or resistance when the price approaches it directly, but rather when the 61.8 support or resistance has already been broken (backward approach). It then transforms into a strong S/R level.

Fibonacci Expansion 100.0

This is thought to be a weak Support & Resistance level. For example, the 1-2-3 pattern point 3 equals or is close to 61.8 of 1-2 retracement, the FE 100 should be a strong S/R level.

Fibonacci Expansion 138.2

This is a level similar to the 61.8 FE, with very similar features.

Fibonacci Expansion 150

A very strong S/R level, usually strong for USD crosses, where the USD is the basic currency (e.g. USD/CHF, USD/JPY, USD/CAD, USD/SGD, etc.). It is a powerful level for EUR-based crosses, where the EUR is the base currency (e.g. EUR/USD, EUR/GBP, EUR/JPY, etc.).

Fibonacci Expansion 161.8

A very powerful S/R level that possibly marks the end of a correction.

Fibonacci Expansion 200

The strongest S/R level that spots the end of a correction, a price reversal, and the change of the trend.

Fibonacci 50.0 with the EMA channel strategy

This strategy is easy to use. It uses the following indicators:

1- EMA 15 set on Close (black)

2- EMA 50 set on High (blue)

3- EMA 50 set on Low (red)

Time Frame: H1

Long Entry Position

Examine if the slope of the channel is sloping up

The price needs to be over the channel

Wait for a retracement

Draw out a Fibonacci retracement of the previous swing from the bottom to the top

The price needs to touch or come close to 23.6, 38.2, and the 50.0 Fibonacci level

Spot a long entry by scaling in (divide your total lot size into three separate entries)

Short Entry Position

Examine if the slope of the channel is sloping down

The price needs to be over the channel

Wait for a retracement

Draw out a Fibonacci Retracement of the last swing from the top to the bottom

The price needs to press or come close to 23.6, 38.2, and the 50.0 Fibonacci level

Spot a short entry by scaling in (divide your total lot size into three separate entries)

How to Apply Fibonacci Trading Tools with Risk-Free Demo Trading

Traders have the power to trade risk-free with a demo trading account. This means that traders can avoid putting their capital at risk, and they can select when they wish to move to the live markets.

About Marketsbloom:

Markets Bloom is a trading academy consisting of former trading industry professionals. Our aim is to help all types of traders looking to trade in the financial markets.

By registering with us, you will gain amazing insights into common issues traders face as well as how to instantly improve your trading approach. Our team of experts will be with you every step of the way on your journey to becoming a better trader.

For more information on our services contact us

Our facebook page: Markets Bloom