Social trading for dummies! what it is & how it works?

An increasing number of people are deciding to practice trading. The development of new technologies and the majority connection to the Internet has democratized access to this field of investment and now anyone can practice it from home. This has introduced new methods of trading and including ones’ self in the trading community. For example, social trading.

What is Social Trading?

A group of users that works in the same way as a social network but around a topic as specific as trading.

Communities of traders start to be formed at the beginning of the century for professionals and they have been opened to retailers interested in learning to trade or in finding experts to copy strategies from.

Social trading is a chance for young people to get closer to the financial market and complex products.. such as CFDs, without prior training.

Social trading, mirror trading & copy trading are they the same?

Social trading, mirror trading & copy trading are 3 terms that are often used interchangeably.

How does social trading work?

It works in a similar way to common social networks like Facebook.. but instead of sharing personal stories, participants debate and talk about trading. An example is MQL5.

We can split the actors that participate in this network into two types:

– Signal providers who share their operations & Those who follow them, asking for advice and winning strategies…Some brokers already offer these types of services.

With Social Trading, traders share their strategies and.. of course, they don’t do it for profit, but rather seek to make a profit. The companies, or online brokers.. that provide this service pay the signal provider either a commission per operation or an agreed-upon monthly fee.

Advantages:

It offers the probability of networking with other traders.. being able to ask questions about all kinds of markets, doubts about techniques, discuss an event that affects investors, etc

It allows you to get in touch with trading without prior training tests and learn slowly from other expert traders.

Those traders who do not support high levels of pressure can find in social trading a way to invest safely.. simply by copying positions of other traders

Disadvantages:

Beginner traders who decide to practice it for their 1st contact with the market can get comfortable, leave their operations in the hands of professionals, and not be properly trained. This leads to a lower perception of risk, which is very risky when deciding how much capital to invest.

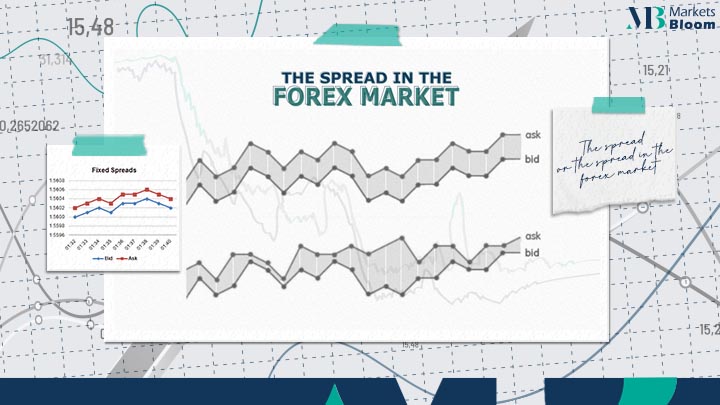

It can include a higher cost since, to the spread that we pay to the broker for each operation, an added commission is added for replicating or copying the signal provider.

Waiting time. There is a probability that, in the time that passes between the signal provider using its strategy and another trader replicating it, the market has changed and therefore is no longer as effective.

There is always the probability that there are traders who try to cheat and emulate successful strategies to gain points and popularity. It is important, therefore, to research before deciding to replicate the strategy of a particular trader.

The risk profile & capital that we have can be different from that of the trader we replicate, so we must be careful when replicating some high-risk strategies such as scalping.

About Marketsbloom:

Markets Bloom is a trading academy consisting of former trading industry professionals. We aim to help all types of traders looking to trade in the financial markets.

By registering with us, you will gain amazing insights into common issues traders face as well as how to instantly improve your trading approach. Our team of experts will be with you every step of the way on your journey to becoming a better trader.

For more information on our services contact us

our facebook page: Markets Bloom